philadelphia property tax rate 2022

For non-residents the rate would decrease from 34481 to 344. City of Philadelphia.

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Buyer Closing Costs Philadelphia Home 750000 purchase price 20 down payment Pennsylvania Realty Transfer Tax 3750.

. They are expected to be uploaded to the property search application by Monday May 9 2022. Resolve business and incomeWage Tax liens and judgments. Typically the owner of a property must pay the real estate taxes.

11 hours agoThe hikes are for the tax year 2023 because citywide reassessments for tax years 2021 and 2022 were postponed due to issues posed by the COVID-19 pandemic. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS.

Loan Origination Underwriting Fees 4500. The Office of Property Assessment OPA determines the value of the property on which the taxes must be paid. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow.

Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Philadelphia Mayor Jim Kenney is proposing using the revenue generated by. Tax Year 2022 assessments will be certified by OPA by March 31 2021.

It will increase by an additional 98 percent next year according to the 2020 property assessments released this month. City officials said those would be. Philly delayed property assessments for three years.

Tax rate for nonresidents who work in Philadelphia. Lawmakers are still hammering out the details to offset the proposed rates. Philadelphia PA 19105.

Philadelphia Realty Transfer Tax 12293. Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make. Just call 215 686-6442 and ask about our Real Estate Tax relief.

Kenneys proposal to soften the impact of the reassessment by lowering the wage tax as opposed to cutting the property tax rate will likely set up a showdown with Council. The delayed filing and payments could. Philadelphia property tax rate 2022 Friday March 18 2022 Edit.

Title Insurance 3750. As a result her tax bill will have increased from 1963 to 2445 between 2018 and 2020. Nisenfelds property assessment or the value used to calculate real estate tax bills increased 149 percent this year.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Appeals to the tax increase must be. Home Inspection 500.

Philadelphia will not reassess properties next year due to operational limitations amid the coronavirus pandemic city officials announced Wednesday. Help is also available to veterans. These rates vary greatly based on the neighborhoods overall security and appeal.

Real Estate Tax bills are sent in December for the. PHILADELPHIA The Kenney administration is forgoing a citywide property reassessment. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments.

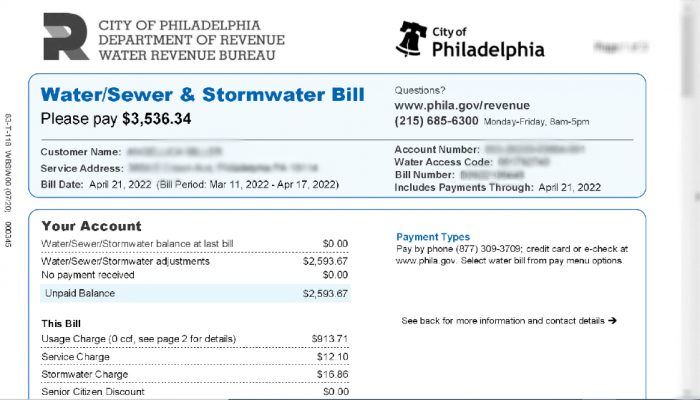

Tax Year 2023 property values are not yet available online. Philadelphia is extending filing and payment dates for some business taxes until July 15 2020 in accordance with the federal extension provided by the IRS. Resolve water liens judgments.

The Realty Transfer Tax This rate includes 3278 to go to the City of Philadelphia and 1 that goes to the Commonwealth. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Use code enforcement numbers to request a payoff.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. Effective July 1 2018 the Realty Transfer Tax rate is increased to 4278 of the sale price or assessed value of the property plus any assumed debt. But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan.

Real Estate Living On Twitter Real Estate Tips Real Estate Infographic Real Estate Agent Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Usa Map Historical Geography. However anyone who has an interest in a property such as someone living in the property should make sure the real estate taxes are being paid. Now residential values are jumping 31.

For city residents the wage tax would decrease from 384 to 37 under Kenneys proposal. The coronavirus pandemic disrupted the citys ability to conduct citywide property assessments for tax year 2022 leading officials to delay the reassessment for another year. The reassessment of Philadelphias 580000 properties is expected to generate 92 million in additional property revenue for the city with the value of the average residential property up 31 from the last assessment.

The fact is that there are single-family houses available in the 4000060000 range that can be rented out to single women with no kids who prefer privacy. Only property owners whose values change will receive notifications. The citys property tax rate is 13998 of the assessed property value.

Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022. Resolve bills or liens for work done by the City on a property. That means that most property owners will keep their current assessments and property tax bills if the citys tax rate remains the same.

Appraisal Fee 600. Important note to property owners. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the.

Pay outstanding tax balances. Philadelphia real estate has a median selling price of roughly 208000. Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax.

Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected. Home philadelphia property rate wallpaper. Philadelphia Realty Transfer Tax rate increase is effective July 1 2018.

Philadelphia County Pa Property Tax Search And Records Propertyshark

St Louis Mo Mo Properties We Want To Congratulate The Following Which Are Considered To Be The Best Real Es Real Estate Agent Real Estate Real Estate News

Keyvest Will Help Sell Your Properties At A Competitive Rate In 2022 Burlington County Property Management Property

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

Pin On 5 The Philadelphia Editor 2018 Edition

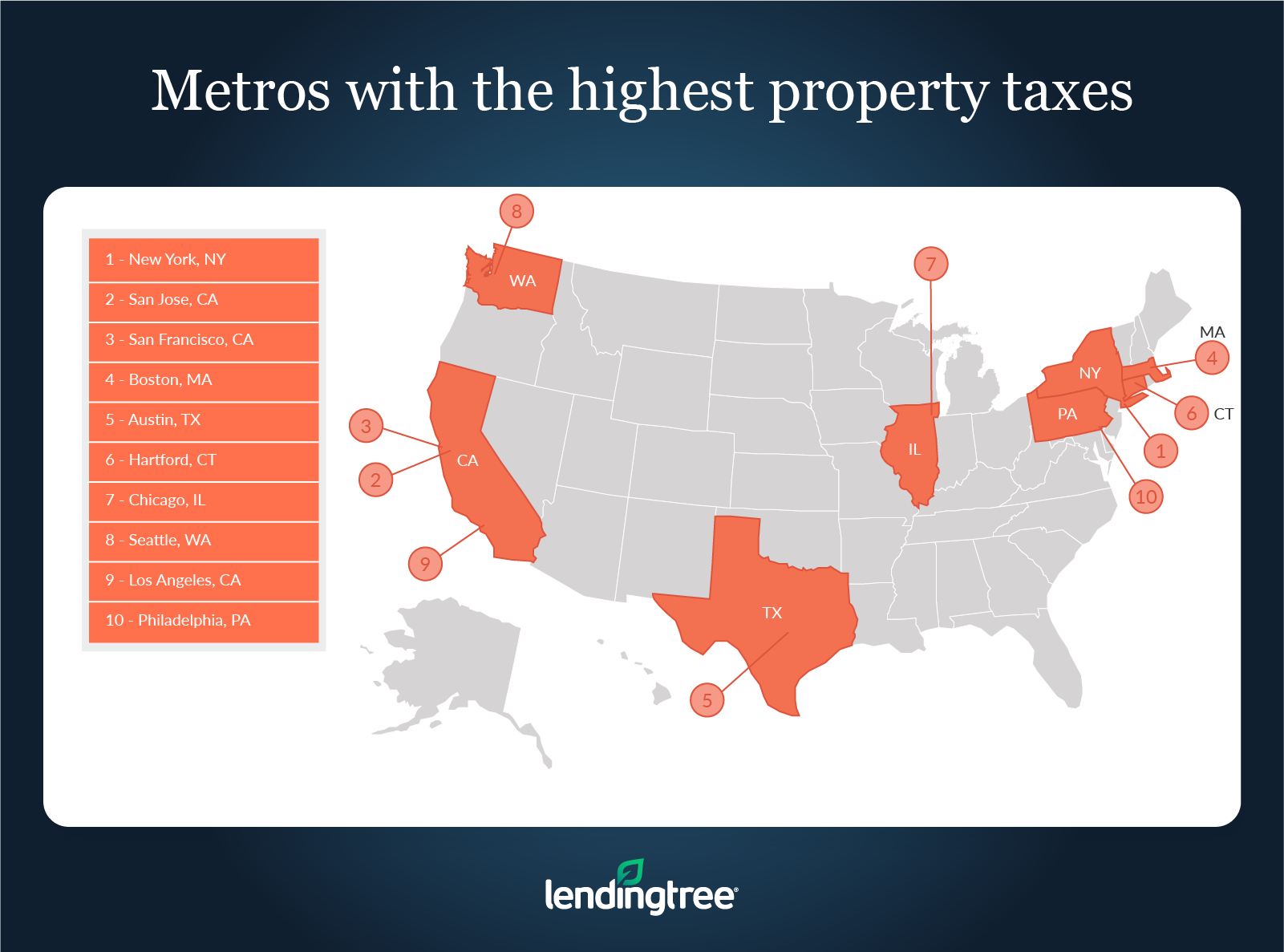

Where People Pay Lowest Highest Property Taxes Lendingtree

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

Where People Pay Lowest Highest Property Taxes Lendingtree

Pin On Semiotics November 2020

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Pennsylvania Property Tax H R Block

Pin By Jennifer Leisher On Social Media Posts In 2022 Real Estate Quotes Real Estate Agent Marketing Real Estate Infographic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Pin On House Hunters Parsons Edition

Like Kind Exchanges Of Real Property Journal Of Accountancy

Newmark Completes Largest Single Asset Multifamily Sale In Philadelphia S History In 2022 Center City History Real Estate

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Rochester Had The Highest Effective Property Tax Rate In The Us Last Year New Report Finds Rochesterfirst